Worksheet 2 Figure Your Additional Taxable Benefits From a Lump-Sum Payment for a Year. Worksheet instead of a publication to find out if any of your benefits are taxable.

Calculator For 2019 Irs Publication 915 Worksheet 1 Frugalfringe Com

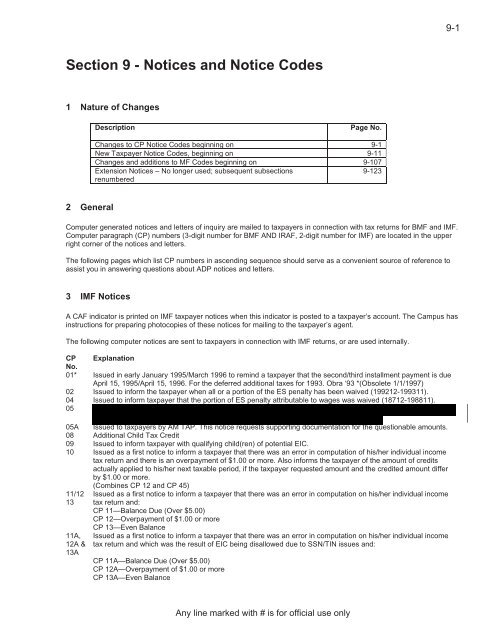

As your gross income increases a higher percentage of your Social Security benefits become taxable up to a maximum of 85 of your total benefits.

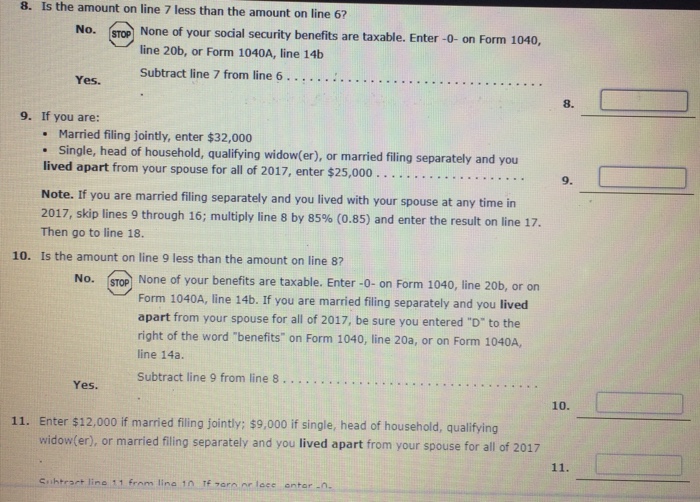

Irs worksheet 1 figuring your taxable benefits. Enter the smaller of line 17 or line 18. Enter the total amount from. Ad The most comprehensive library of free printable worksheets digital games for kids.

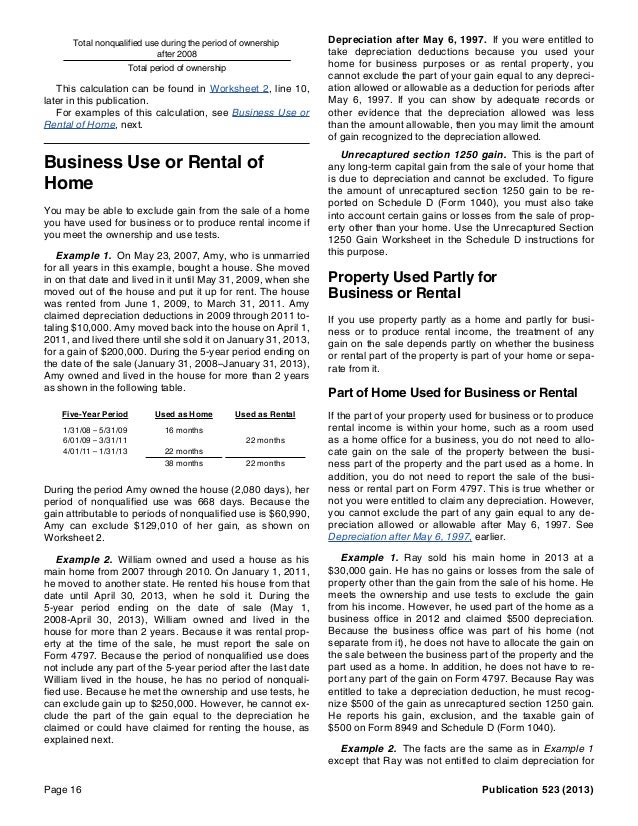

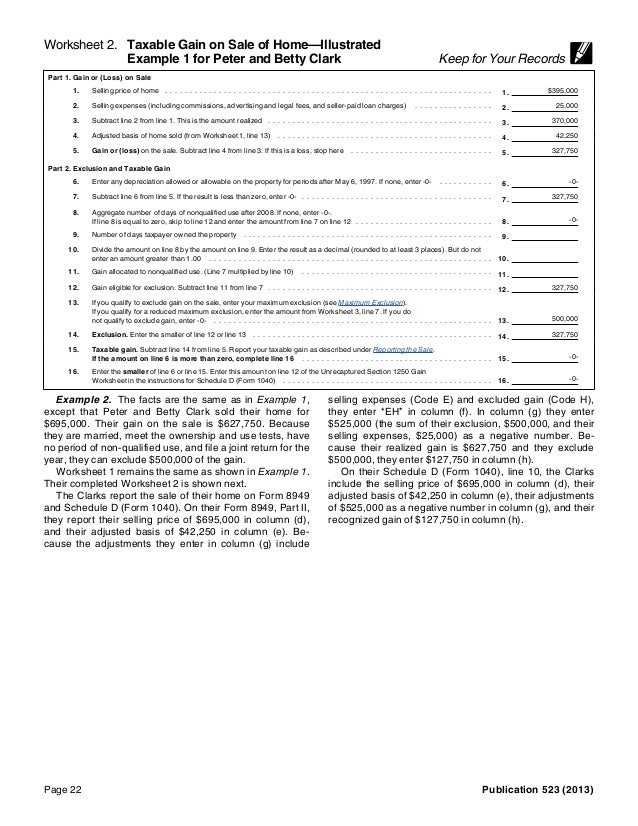

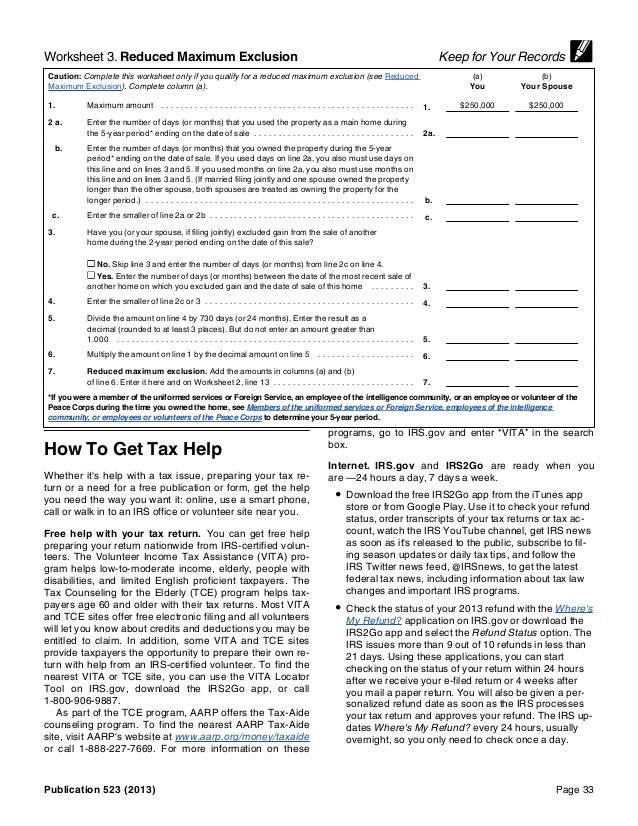

Worksheet 1 - Taxable Social Security Benefits Calculation for Form 1040 Lines 20a and 20b If you are married filing separately and you lived apart from your spouse for all of 2010 enter D to the right of the word benefits on Form 1040 line 20a. Worksheet 2 Figure Your Additional Taxable Benefits From a Lump-Sum Payment for a Year After 1993. Do not use this worksheet if you repaid benefits in 2010 and your total repayments box 4 of Forms.

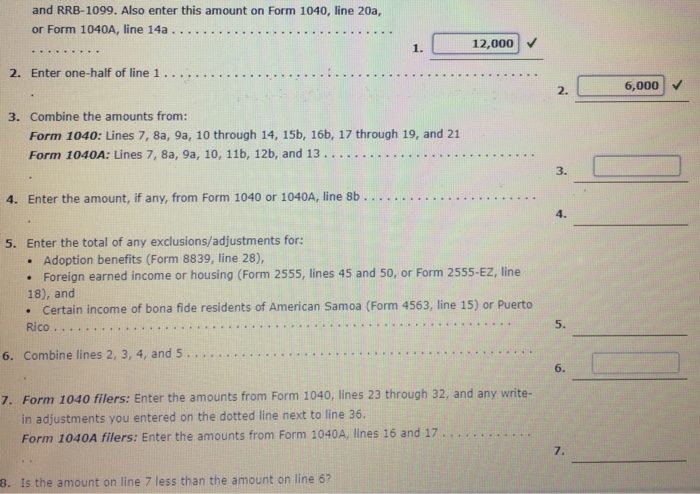

On line 20b he enters his taxable benefits of 2990. If your social security benefits are taxable you must report them to IRS by filing appropriate tax return-Form 1040 or the Form 1040-SR US. TaxAct supports Worksheet 1 Figuring Your Taxable Benefits from IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits and calculates your taxable social security benefits for you from the information you have entered in the program.

If you are married and file a joint return for 2020 you and your spouse must combine your incomes and your benefits to figure whether any of your combined benefits are taxable. 21 rows Calculator for 2019 IRS Publication 915 Worksheet 1. Savings Bonds issued after 1989 the.

Also enter this amount on Form 1040 line 5a. I If you are married ling separately and. Worksheet 3 Figure Your Additional Taxable Benefits From a Lump-Sum Payment for a Year Before 1994.

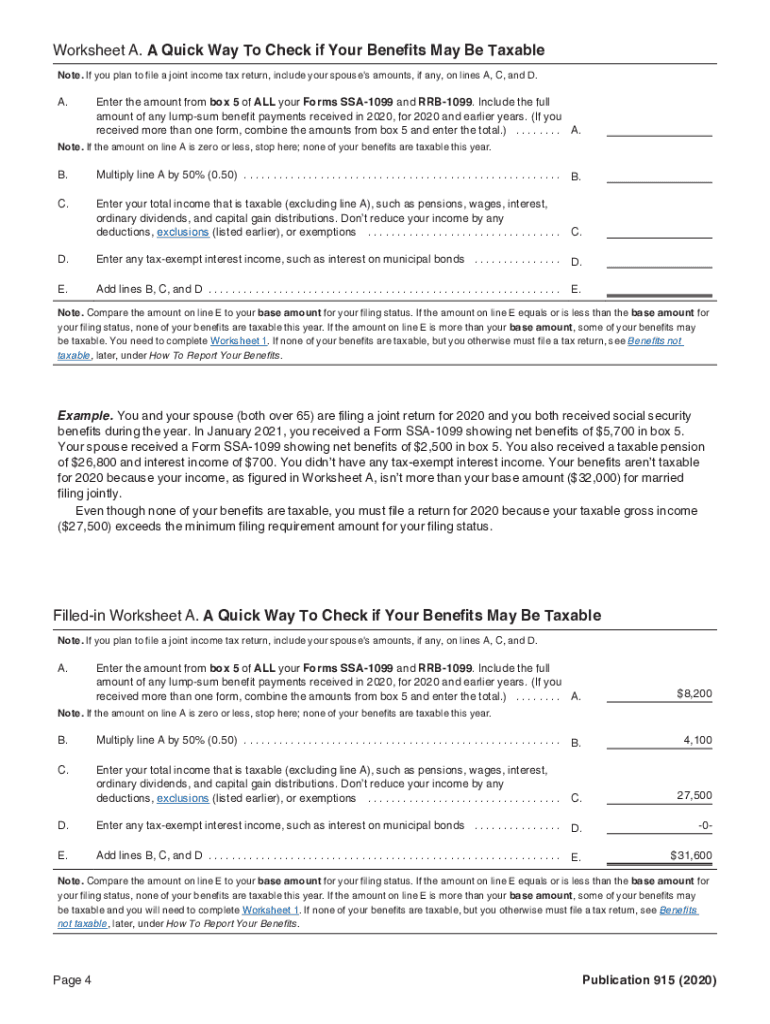

If you are married filing separately and you lived apart from your spouse for all of 2016 enter D to the right of the word benefits on Form 1040 line 20a or Form 1040A line 14a. To figure his taxable benefits George completes Worksheet 1 shown below. Ad The most comprehensive library of free printable worksheets digital games for kids.

On line 20a of his Form 1040 George enters his net benefits of 5980. None of your. Do not use this worksheet if you repaid benefits in 2016 and your total.

Combine the amounts from Form 1040 lines 1 2b 3b 4b and Schedule 1 line 22. Worksheet 1 Figuring Your Taxable Benefits. Multiply line 1 by 85 85 Taxable benefits.

Get thousands of teacher-crafted activities that sync up with the school year. Tax Return for Seniors and filling in the appropriate fields. Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments.

Also enter this amount on Form 1040 line 20b or Form 1040A line 14b If you received a lump-sum payment in 2016 that was for an earlier year also complete Worksheet 2 or 3 and Worksheet 4 to see if you can report a lower taxable benefit. Worksheet 2 Figure Your Additional Taxable Benefits From a Lump-Sum Payment for a Year. When figuring any of the following deductions or exclusions include the full amount of your unemployment benefits reported on Schedule 1 line 7.

If your income is modest it is likely that none of your Social Security benefits are taxable. Worksheet to Figure Taxable Social Security Benefits. Worksheet 4 Figure Your Taxable Benefits Under the Lump-Sum Election Method Use With Worksheet 2 or 3.

More specifically if your total taxable income wages pensions interest dividends etc plus any tax-exempt income plus half of your Social Security benefits exceed. Get thousands of teacher-crafted activities that sync up with the school year. Multiply line 1 by 50 050.

Figuring Your Taxable Benefits Keep for Your Records Before you begin. Social Security Benefits Worksheet - Taxable Amount. TaxAct supports Worksheet 1 Figuring Your Taxable Benefits from IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits and calculates your taxable social security benefits for you from the information you have entered in the program.

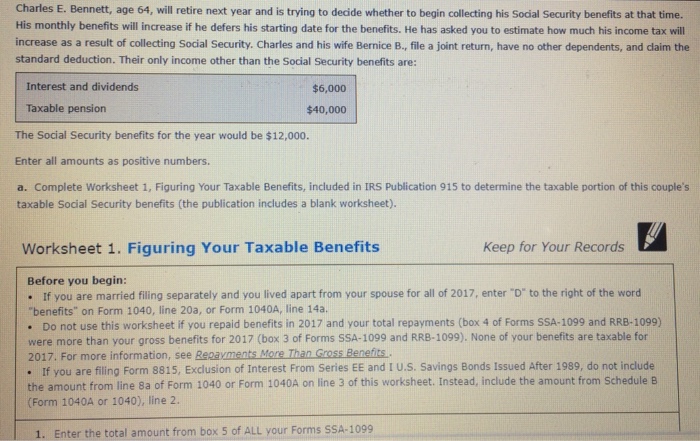

Complete Worksheet 1 Figuring Your Taxable Benets included in IRS Publication 915 to determine the taxable portion of this couples taxable Social Security benets the publication includes a blank worksheet. Do not use this worksheet if you repaid benefits in 2017 and your total repayments box 4 of Forms SSA-1099 and RRB-1099 were more than your gross benefits for 2017 box 3 of Forms SSA-1099 and RRB-1099. Even if your spouse didnt receive any bene-fits you must add your spouses income to yours to figure.

Figuring Your Taxable Benefits Keep for Your Records a Before you begin. Box 5 of all your Forms SSA-1099 and Forms RRB-1099. Figuring Your Taxable Benefits Keep for Your Records Before you begin.

Taxable social security benefits IRA deduction student loan interest deduction nontaxable amount of Olympic or Paralympic medals and USOC prize money the exclusion of interest from Series EE and I US. For precise computation of taxable amount out of social security benefit use Worksheet 1 of Pub 915 Should you file tax return if social security taxable. If you are married filing separately and you lived apart from your spouse for all of 2017 enter D to the right of the word benefits on Form 1040 line 20a or Form 1040A line 14a.

Amount part of your benefits may be taxable. As always none of your inputs are stored or recorded. Figuring Your Taxable Benefits Keep for Your Records Before you begin.

This calculator figures your taxable social security benefits based upon the IRSs 2018 Form 1040 2018 Schedule 1 and 2018 Publication 915 Worksheet 1 which was published January 9 2019 and made no substantive changes to the 2017 worksheet calculations.

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

A Complete Worksheet 1 Completing All Blanks 1 19 Chegg Com

Irs Courseware Link Learn Taxes

A Complete Worksheet 1 Completing All Blanks 1 19 Chegg Com

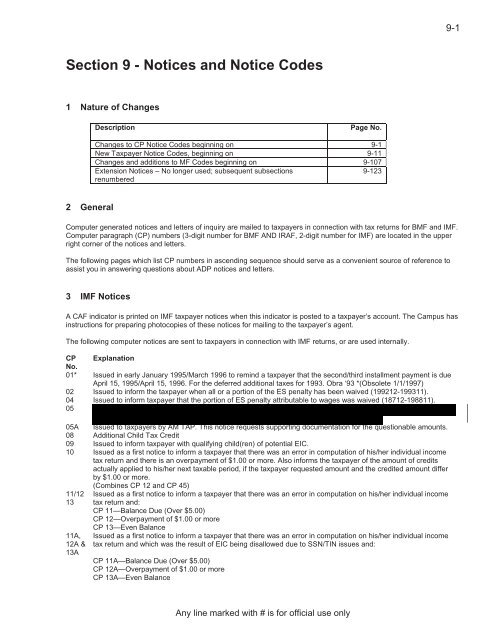

Section 9 Notices And Notice Codes Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

2020 Form Irs Publication 915 Fill Online Printable Fillable Blank Pdffiller

2020 Instructions For Schedule H 2020 Internal Revenue Service

Instructions For Form 8995 2019 Internal Revenue Service Workbook Federal Income Tax Internal Revenue Service

0 comments:

Post a Comment